carbon tax benefits and disadvantages

A carbon tax and cap-and-trade are opposite sides of the same coin. However the global average carbon price is 2 a ton a small fraction of the estimated 75 a ton price in 2030 consistent with a 2 C warming target according to the report.

Advantages And Disadvantages Of Multiple And Single Sourcing Strategy Download Table

Emissions but would have only a modest effect on the Earths climate without a worldwide effort.

. A criticism of tax-raising schemes is that they are frequently not hypothecated and so some or all of the taxation raised by a government would be applied based on what. The first carbon tax implemented by. The IMF estimates.

That may sound a little wonky but she added that she and many. Studiesincluding those coming from carbon tax proponentscarbon taxes slow economic growth unless a large portion of the tax revenue is allocated to corporate tax reductions. Determining the Tax Rate That Best Balances the Benefits and Costs of a Carbon Tax 17 The Timing of Action 18 About This Document 20 Figure 1.

The carbon tax is a method of taxing pollution. Higher fatigue strength error corrected Disadvantages. You can get out of a carbon tax by switching to renewable or alternative fuels for your.

Does not fail as predictably snaps instead of bending I think it also has slightly lower compression strength putting limitations on its use for example requiring that you dont clamp it too tight in handlebars and posts. One of the most common announcements one hears from companies looking to improve their environmental impact is the decision to become carbon neutral often through carbon offsets. Many companies cant reduce their emissions as much as theyd like to.

In addition to making fossil fuels more expensive a carbon tax imposes a greater burden on those with lower incomes since it increases their prices. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage. Carbon Tax - The revenue that a carbon tax generates can be used to encourage investment in more renewable energy projects by offering subsidies to companies who build low or no-carbon plants.

Advantages of Carbon Taxes. There are additional benefits to be reaped from the implementation of either a carbon tax or CAT system other than just a reduction in emissions. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint.

The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere. As Camila Thorndike the dynamic young leader of an effort to get a carbon price passed in Oregon told the Democrats at their platform hearings As a cross-sector and market-based solution a carbon tax empowers business to profitably transition to the clean-energy economy. It is easier and quicker for governments to implement.

One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing an incentive to avoid the tax by reducing emissions. Company A will pay 1275 to eliminate 50 units for itself Company B will pay 1122 to eliminate 33 units for itself. It levies fess on the production or distribution of fossil fuels and the people or agencies who use them.

2 days agoCarbon credits and carbon taxes each have their advantages and disadvantages. Carbon tax as a reflection of societys willingness to pay to reduce the risk of potentially very expensive damage in the future. 14 Advantages and Disadvantages of Carbon Tax.

Its an appealing idea but one that can be inordinately complicated as any company that has undergone this process can. A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions.

Gas electricity and food will account for a higher proportion of their incomes. A carbon tax can have a positive effect on the local economy. A carbon tax is one way to put a price on emissions.

Carbon offsetting has benefits at both ends of the process. There are disadvantages to doing it. This carbon tax would be on energy producers not consumers and the revenues would be spent as follows.

A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources. A carbon tax is paid for by the people who use the fuel. The tax would help reduce US.

The market price is P1 but this ignores the external cost of pollution. Tax on carbon will induce firmsplants to push for green production processes in addition to raising revenue which can be used to promote environment-friendly initiatives. Carbon taxes have been suggested as a way to internalise the negative externality of carbon emissions.

The Pros of Carbon Offsetting. A carbon tax can be very simple. The voluntary carbon offset credit market has the potential to play a major role in allowing society to continue to emit greenhouse gases while striving to keep global warming under 15 degrees.

It is a form of carbon pricing and aims to reduce global carbon emissions in order to mitigate the global warming issue. Effects of a Carbon Tax on the Economy and the Environment. This process makes the dirtier fuels more expensive to use encouraging everyone to reduce consumption increase efficiencies or.

The revenue could be used to. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. - 30 on lower income populations the ones who need it the most - 15 on trade-exposed.

Credits were chosen by the signatories to the Kyoto Protocol as an alternative to carbon taxes. However there is a view that industrial units may shift to countries with lower or no carbon taxes. Governments set a price per ton on carbon which translates into taxes on oil natural gas and electricity.

Under the carbon credits scheme. A carbon tax of P2-P0 would raise the price to P2 and cause a more socially efficient level of output. Effects of a Carbon Tax on Labor Investment and Output 7.

Although the carbon tax has some important advantages it also implies some problems. The Benefits and Drawbacks of Carbon Offsets. Lawmakers could increase federal revenues and encourage.

A carbon tax also has one key advantage. A carbon tax sets the price of carbon dioxide.

Advantages And Disadvantages Of Carbon Tax Benefits

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

Carbon Tax What Are The Pros And Cons Climateaction

Advantages And Disadvantages Of Internet Top 5 Advantages And Disadvantages Of Internet Communication A P In 2022 Internet Offers Networking Websites Communication

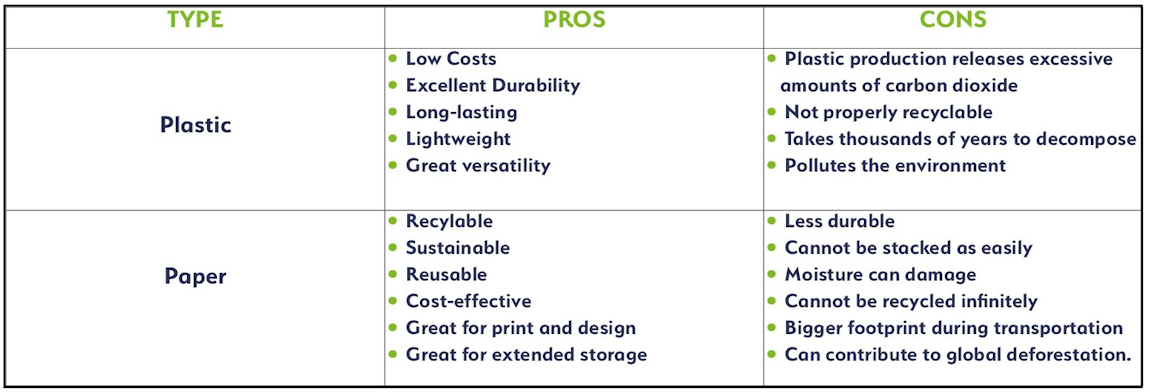

Plastic Vs Paper Packaging The Pros And Cons

Pin On Advantages And Disadvantages

Carbon Tax Advantages And Disadvantages Economics Help

Advantages And Disadvantages Of Geothermal Energy Uses Benefits And Drawbacks Of Geothermal Energy A Plus To Geothermal Energy Geothermal Potential Energy

Carbon Tax Pros And Cons Economics Help

27 Main Pros Cons Of Carbon Taxes E C

Pin On Advantages And Disadvantages

What Is A Carbon Tax Carbon Fossil Fuels Power Plant

28 Crucial Pros Cons Of Carbon Offsetting E C

Carbon Tax Pros And Cons Economics Help

8 Pros And Cons Of Carbon Tax Brandongaille Com

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com